From gas to food to clothing, consumers in the United States continue to get hit in the wallet due to rising inflation, supply chain issues, and reconstruction and labor costs. Homeowners in some states are also seeing their insurance premiums more than double due to more extreme weather and climate disasters, according to a 2024 Policygenius Home Insurance Pricing Report.

The report compiled data from May 2022 to May 2023 and found that home insurance premiums were up an average of 21%, costing homeowners an average of $1,754 per year, or $146 a month.

By August 2024, the Consumer Price Index, a measurement of price changes for commonly purchased goods and services, decreased the national inflation rate to 2.5%. It was the lowest rate since February 2021.

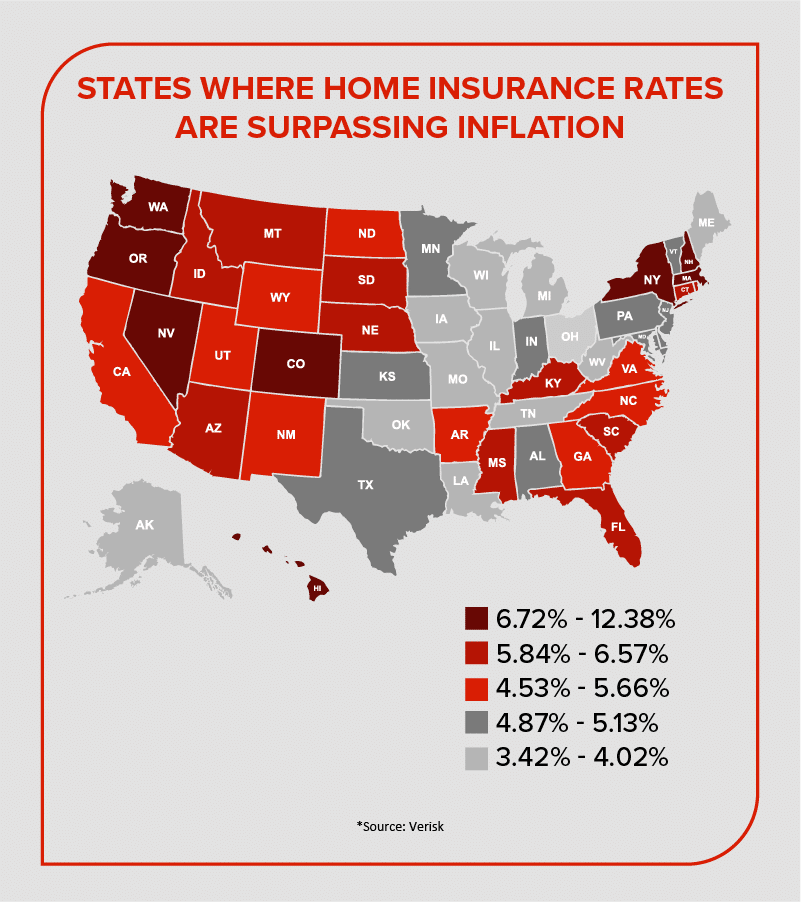

Despite the decrease in inflation, a July 2023 to July 2024 study by Verisk, a global data analytics and technology provider, found reconstruction costs due to claims, including materials and labor, in all states increased by 5.2%. The states that saw the biggest increase were New Hampshire at 9.6%, Colorado at 9.05%, and Nebraska at 6.37%.

Many factors besides inflation and claims have caused home insurance rates to rise. The age of your home, your home’s estimated cost to rebuild, and how high your deductible is are all considerations. Where your house is located and if it is susceptible to extreme weather is another major factor in rising premiums. In addition, the rising costs of building materials, a labor shortage, and increasing insured losses related to natural weather events like wildfires, hurricanes, tornadoes, and other types of storms have all contributed to high costs.

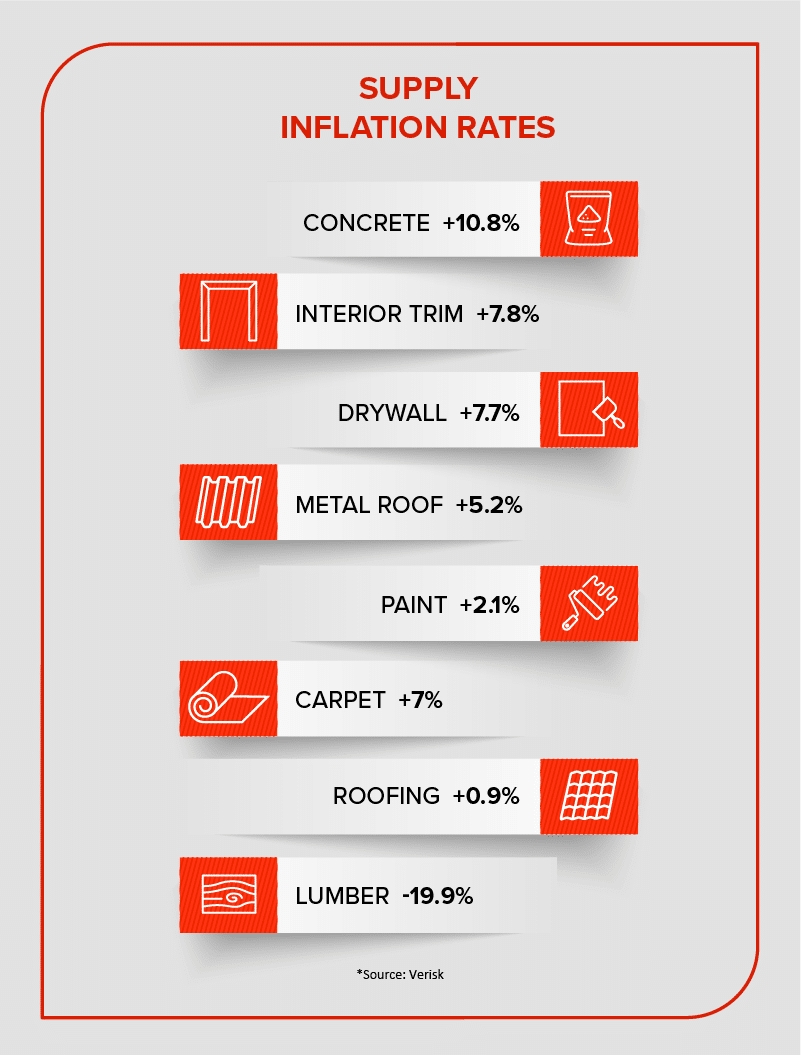

If you’ve had to file a home insurance claim, you probably had to deal with a supply chain issue at some point even if you didn’t know it. Sometimes this is a longer wait for specific materials to arrive and other times it may be a much more limited selection due to availability frequently affecting materials like doors, shingles, or windows.

While the supply chain issue has eased since the pandemic, Verisk found that from October 2022 to October 2023, lumber was the only material cost to decrease.

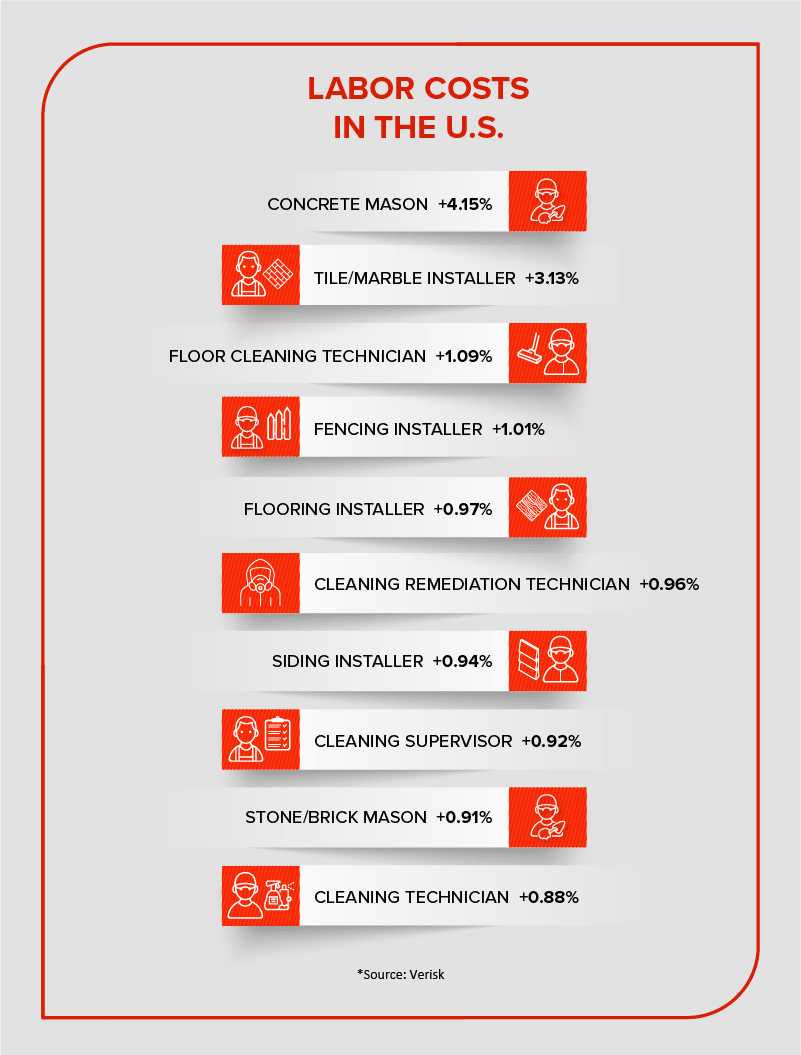

And as some materials are hard to come by, so are skilled workers. Verisk found that the growth of total costs outstripped the total inflation rate for the year at 4.1%. That was from 3.2% the previous year. The labor residential and commercial labor costs grew for many fields of expertise causing companies to pay higher rates for labor.

While MAPFRE Insurance cannot control many of these factors contributing to home repair delays or costs, we can help you through the steps you need to follow should you need to file a homeowner’s claim.

An option to help expedite your claims process is using MAPFRE’s ePICS® Program for Homeowners. The ePICS® Program is a self-service damage assessment option offered to customers who have a claim with limited damage, such as a broken fence or mailbox. Customers can submit photos and answer basic questions about their damage through the ePICS platform from any device. Once the damage is assessed, a check is issued to the customer within a matter of days in many cases.

For more extensive damage, MAPFRE offers a unique expedited home repair service called the Select Home Restoration ProgramSM that helps you get back to pre-loss conditions. With MAPFRE’s Select Home Restoration Program, the repair process is accelerated, and many of the services provided under the program are guaranteed. MAPFRE Insurance has partnered with “Select” restoration providers to deliver fast and high-quality home repair services.

These partners adhere to high professional standards, have excellent reputations, and provide superior customer service. When you’ve had unexpected damage to your property, your home restoration process should be quick and easy. While we cannot control some of the rising material costs due to inflation or delays due to supply chain issues, utilizing our Select Home Restoration Program can help streamline your homeowner’s claim process as much as possible.

Are you unsure what your home insurance policy covers, or do you need to add additional coverage? No problem! Your independent agent in your state can always review your policy with you to make sure you have the right coverage that suits your individualized needs.

And if you don’t have MAPFRE for your home insurance, you can get the right coverage for your property by calling an independent insurance agent in your state or, if you live in Massachusetts, by getting a fast, free quote today!