Blog

The Benefits of Service Line Coverage

As a homeowner, you rely on things working smoothly, such as your home’s electrical, heating, cooling, plumbing, and sewer systems. Because these systems are imperfect, they are bound to fail or be damaged at some point, causing costly repairs or replacements. Having...

Preparing Your Home for an Ice Storm

If you live in a cold climate, you're likely familiar with harsh winter conditions such as snow, sleet, and occasional blizzards. While preparing for these weather events is essential, it's also crucial to get your home ready for the possibility of ice storms....

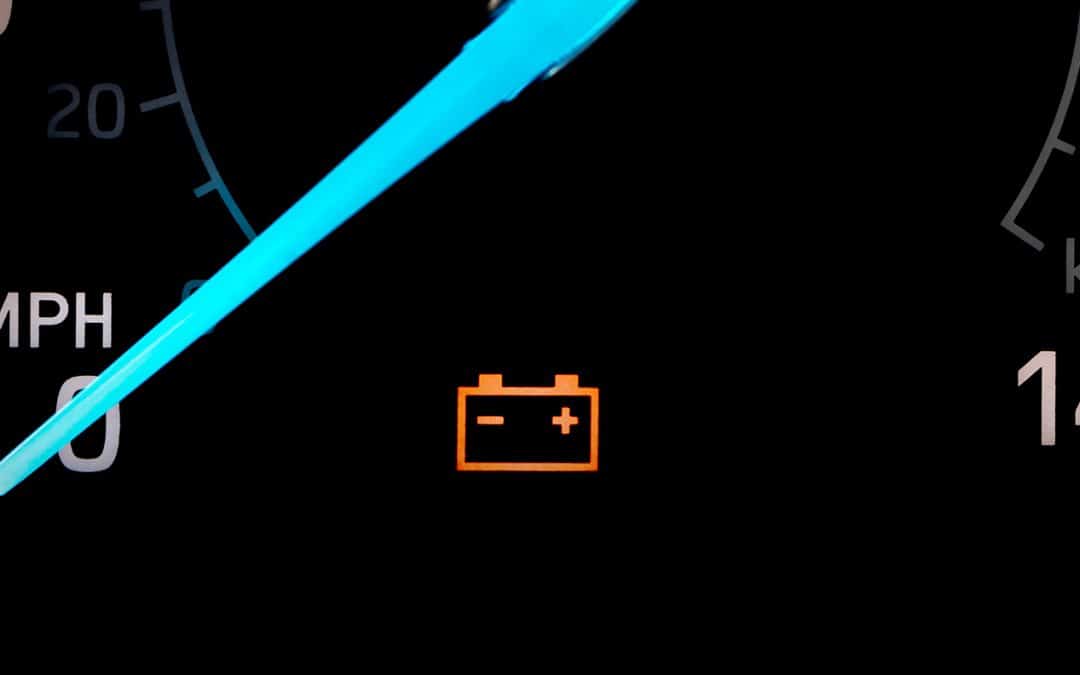

How to Tell If You Need a New Car Battery

When it comes to car maintenance, the battery is often overlooked. On average, a car battery lasts about four years under normal conditions before it needs replacement; however, many drivers only think about it after an unexpected breakdown. It's easy for the battery...

Mapfre Insurance: New look, same promise to you

For more than 50 years, Mapfre Insurance has been caring for what matters most to our customers. We’re proud to unveil a renewed brand identity, the first in almost four decades, designed to reflect our transformation and our ambition for the future. This evolution is...

Tips to Avoid Outdoor Winter Hazards at Home

As the snow starts to blanket our homes in a glistening layer of white, many of us find ourselves amid winter wonderland magic. However, for homeowners in colder climates, the beauty of winter also comes with its own challenges, especially when managing the risks...

Top 6 Benefits of Attic Insulation Every Homeowner Should Know

When it comes to maintaining the integrity of your home, one aspect that often gets overlooked is attic insulation. While it may not be the most fun home maintenance project, proper attic insulation protects your roofing structure and ensures your home remains...