If you are walking down the aisle soon with that special someone, it’s a good time to start establishing a joint financial plan. Because legally getting married in Massachusetts has an immediate impact on finances, there are some things you should plan ahead of time before you tie the knot.

Discuss goals and debt

It’s a good idea to discuss things like each other’s spending habits, short and long-term financial goals, how much you both make, how you plan to save for the future, and how much debt each of you has as a couple. These are all things that will help you determine how to budget and pay monthly bills.

Check credit reports

While discussing financing plans is key, recent credit reports should be run to see where each of you stands. It’s important to remember that once married, one person’s credit rating will impact the score of their partner. This can affect the ability to apply for loans, cars, and credit cards.

Budgeting bills

When paying the bills, like the mortgage or rent, utilities, car payments, groceries, etc., how do you plan to divide the expenses? Some couples divide these things equally, while others pay their share from their accounts. Whatever option you choose, it’s something that should be discussed beforehand, and the division of bills is fair for both.

Managing bank and credit card accounts

Like bills, managing bank accounts should also be a priority for the couple. Do you plan to keep separate bank accounts or merge them to pay expenses? While some couples might see merging accounts as a privacy issue, others might see it as a way of better managing finances.

Another option to consider is adding your partner to your credit card account. This could either help or hinder your credit score.

What paperwork do I need to get married in Massachusetts?

Before you get married in Massachusetts, you must apply for a marriage license. There is a 3-day waiting period once you apply and you and your future spouse must go to a city or town clerk in person to fill out a Notice of Intention of Marriage Form. Both of you will need to provide the following:

- Proof of age, such as a birth certificate or passport.

- Social Security number.

- Payment for fees, which vary by town.

- The name you’ll use after the wedding.

Once you pick up your marriage license, it is valid for 60 days. The license can then go to the person conducting your ceremony, who must sign and return it to the Massachusetts city or town clerk who issued it before the 60-day lapse.

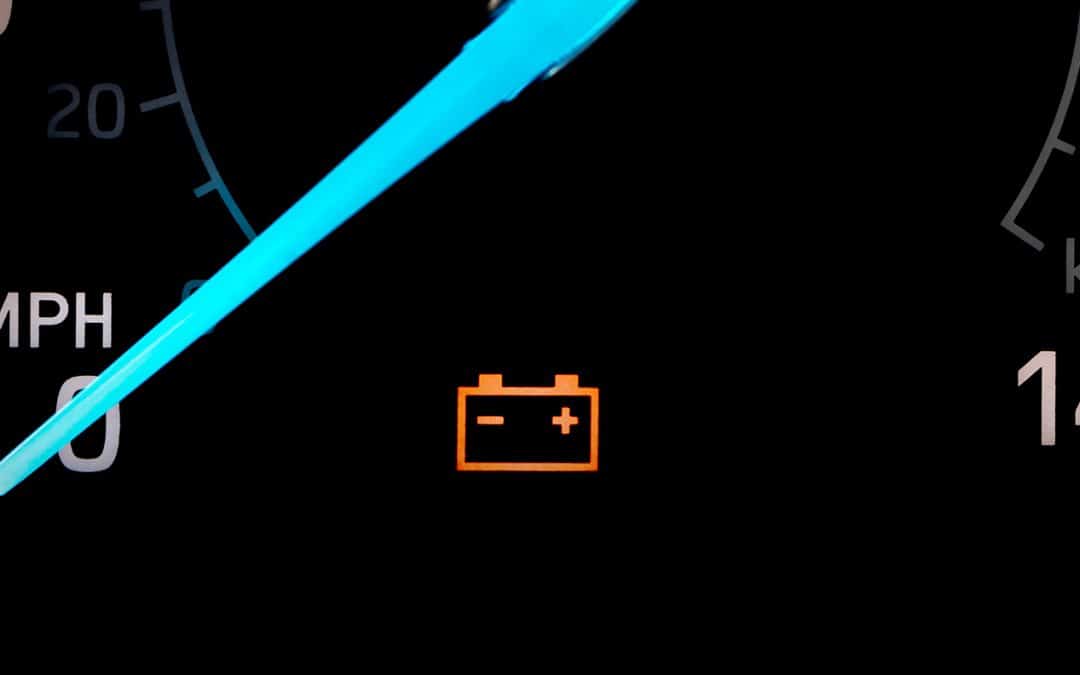

How getting married affects auto insurance

When couples tie the knot, they often have cars and different insurance companies. If this is your situation, this is a good time to review existing Massachusetts auto insurance coverages to see which company offers the best price and service.

While there is no legal requirement that states you must add your spouse’s vehicle to your Massachusetts auto policy, if both you and your partner have good driving records, you can potentially save by combining policies after marriage. With MAPFRE, you could qualify for a multi-policy discount. It also saves you time by managing one combined policy rather than two.

However, there might be reasons to keep your policies separate from your partner. If your spouse has a large accident history or several speeding tickets, you could see your rates rise. If their vehicle is of high value or if your partner drives much more than you, combining policies could raise your payments as well.

Keep in mind that to add your partner to your policy or you to theirs, your independent agent must be contacted, as the coverage is not automatic after you say “I do”.

How getting married affects home insurance

If you and your partner are living separately, one of you will most likely stop renting or sell their Massachusetts property once married. If this is the case, only one renter or home insurance policy is needed. It’s important, however, to notify your agent ahead of time to add your spouse to your policy and check if your coverage amounts are sufficient to cover both of your combined assets in the home. If not, you may need to increase the coverage limits on your policy.

If you are selling one of the two homes to consolidate, be sure to keep the home insurance policy on that home active until it has sold.

We hope you found these pre-wedding financial tips helpful! Remember, you can always have an independent Massachusetts agent review your auto and home policies to make sure you have the right coverage suited to your individualized needs. If you’re not yet insured with MAPFRE, get a fast, free quote today!